KOLUMN Magazine

Where

the Black Dollar

Goes Now

As major retailers retreat from their diversity promises, a new generation of guides—like BRANDED, BLACKNESS—are reshaping how Black consumers find, trust, and support Black-owned businesses.

By KOLUMN Magazine

On a gray Saturday in February, the beauty aisle feels like a tiny, fluorescent universe.

In one corner of a big-box store outside Atlanta, a young woman stands between two nearly identical rows of serums and shampoos. The packaging is all soft pastels and serif fonts, the kind of design language that seems engineered to soothe. She knows that somewhere on these shelves there are products created by Black founders—brands that formulated for coils like hers, for hyperpigmentation that shows up on brown skin, for the particular alchemy of melanin and moisture.

But the bottles don’t boldly announce Black-owned. The shelf tags don’t mention it. She pulls out her phone, taps open a site she bookmarked during Black Business Month: BRANDED, BLACKNESS, a new digital guide to Black-owned beauty and wellness brands. A few swipes later, she has a shortlist of names she recognizes from Instagram and a few she doesn’t.

Then she turns back to the aisle and starts scanning labels like they’re clues.

That small hesitation—standing between what’s available and what’s visible—is where the modern “buy Black” movement now lives. It is no longer just about finding a Black-owned bookstore in a segregated city, or a Black bank that will extend credit when others will not. It’s navigating a marketplace flooded with choice, where Black brands are finally on national shelves just as major retailers begin rolling back the diversity programs that put them there. It’s about choosing where to shop, but also how to know.

And increasingly, it’s happening with a directory in your pocket.

The long arc of buying Black

Long before hashtags and holiday campaigns, Black America’s relationship to the marketplace was explicitly political. In the 1930s, the “Don’t Buy Where You Can’t Work” boycotts in cities like Chicago and Washington, D.C., used collective purchasing power to demand jobs and fair treatment from white-owned businesses that profited from Black customers while excluding Black workers.

Later, in the mid-20th century, civil rights organizers tied consumer boycotts to sit-ins and marches. By the time economic thinkers and activists began talking explicitly about “buy Black” in the 1960s and ’70s, the idea that dollars could double as protest was already familiar.

The concept resurfaced again in the 2010s, as digital campaigns like #BuyBlack, We Buy Black and Bank Black urged consumers to redirect everyday spending to Black-owned firms and financial institutions.

Banking, in particular, became a stage where ordinary account holders—checking customers with modest balances—could make a symbolic stand. In the wake of police killings and the rise of Black Lives Matter, organizations like OneUnited Bank and BMe Community encouraged Black Americans to deposit their money in Black-owned banks, arguing that those institutions were more likely to extend credit to Black entrepreneurs and homeowners.

In those stories—of the small business owner turned down three times elsewhere before a Black bank said yes; of the church that moved its accounts as an act of solidarity—the bank customer is not a passive figure. They are a participant in an economic experiment: what happens when Black households and businesses decide, collectively, to keep more of their money circulating in Black institutions?

That question has only grown more urgent as the numbers have become impossible to ignore.

Trillions at stake, and a thin slice of the pie

Black consumers wield enormous economic power. Recent analyses from Nielsen and NIQ estimate that Black buying power is projected to reach roughly $2.1 trillion by 2026, more than double its level in 2000. Black consumers are also unusually values-driven: one Nielsen study found that about two-thirds say they will look for alternatives if a brand doesn’t align with the causes they care about.

And yet, for all that spending, Black-owned businesses still occupy a slim corner of the U.S. economy. The Census Bureau reported this November that Black- or African American–owned firms accounted for about 3.4% of employer businesses—roughly 201,000 companies—with $249 billion in receipts.

That sliver is starting to widen. Between 2017 and 2022, the number of majority Black-owned employer firms increased from 124,004 to 194,585—a jump of 56.9%, accounting for more than half of all net new employer firms in that period. Their gross revenues grew by 66%, to more than $211 billion.

Black-owned businesses, in other words, are growing faster than the economy as a whole. But they are still playing catch-up: Black Americans make up around 14% of the U.S. population and own just a tiny fraction of employer firms and total business revenue.

The flip side of those numbers is what researchers often call “consumer deserts”: neighborhoods where there may be plenty of places to spend, but too few that are owned by the people who live there, or that offer the kinds of products and services Black consumers say they actually need. McKinsey analysts have argued that even as Black consumption is projected to reach $1.7 trillion by 2030, Black households are more likely than others to be underserved across food, health, banking, and fashion.

That mismatch—between power and access, dollars and ownership—is partly what the modern buy-Black movement is trying to close.

The visibility problem

When people talk about buying Black in 2025, they rarely mean just any transaction with a Black entrepreneur. They are describing a layered act: a vote of confidence, a reciprocal exchange, an attempt to repair history. But before any of that can happen, there’s a more prosaic question to solve:

Where, exactly, do I find the businesses?

“Everyone loves to say ‘Buy Black’—until it’s time to find one,” writes one organizer in an op-ed for BuyBlack.org, describing what she calls a “visibility crisis” facing Black businesses: quality isn’t the problem; discoverability is.

In response, a whole ecosystem of guides, apps, and directories has emerged. Word In Black recently highlighted tools like EatOkra (for Black-owned restaurants), Miiriya (a marketplace for Black-made products), and the National Black Guide, among others.

There are national directories, such as BuyBlack.org, which bills itself as “the largest directory of Black-owned businesses in the United States,” and certification platforms like ByBlack, created by the U.S. Black Chambers, which verifies that companies are at least 51% Black-owned and operated.

But the sheer number of tools reflects how fragmented this landscape remains. Many apps lean heavily on user submissions or loose algorithms, leading to inaccurate listings that can include any business with “Black” in its name.

This is the gap that BRANDED, BLACKNESS is trying to occupy.

A guide born in the post-DEI whiplash

When major retailers rushed to stock Black-owned products after the racial justice uprisings of 2020, they sold those decisions as long-term commitments. Black founders who had spent years bootstrapping were suddenly in national chains; consumers could see “Black-owned” shelf tags alongside legacy brands.

That era is already fading. Over the past two years, companies from Walmart to Target to Tractor Supply have rolled back or rebranded DEI programs, under legal pressure and political organizing from the right. Black-owned brands that once saw DEI as the doorway to mass retail now talk openly about how fragile that access has proven to be.

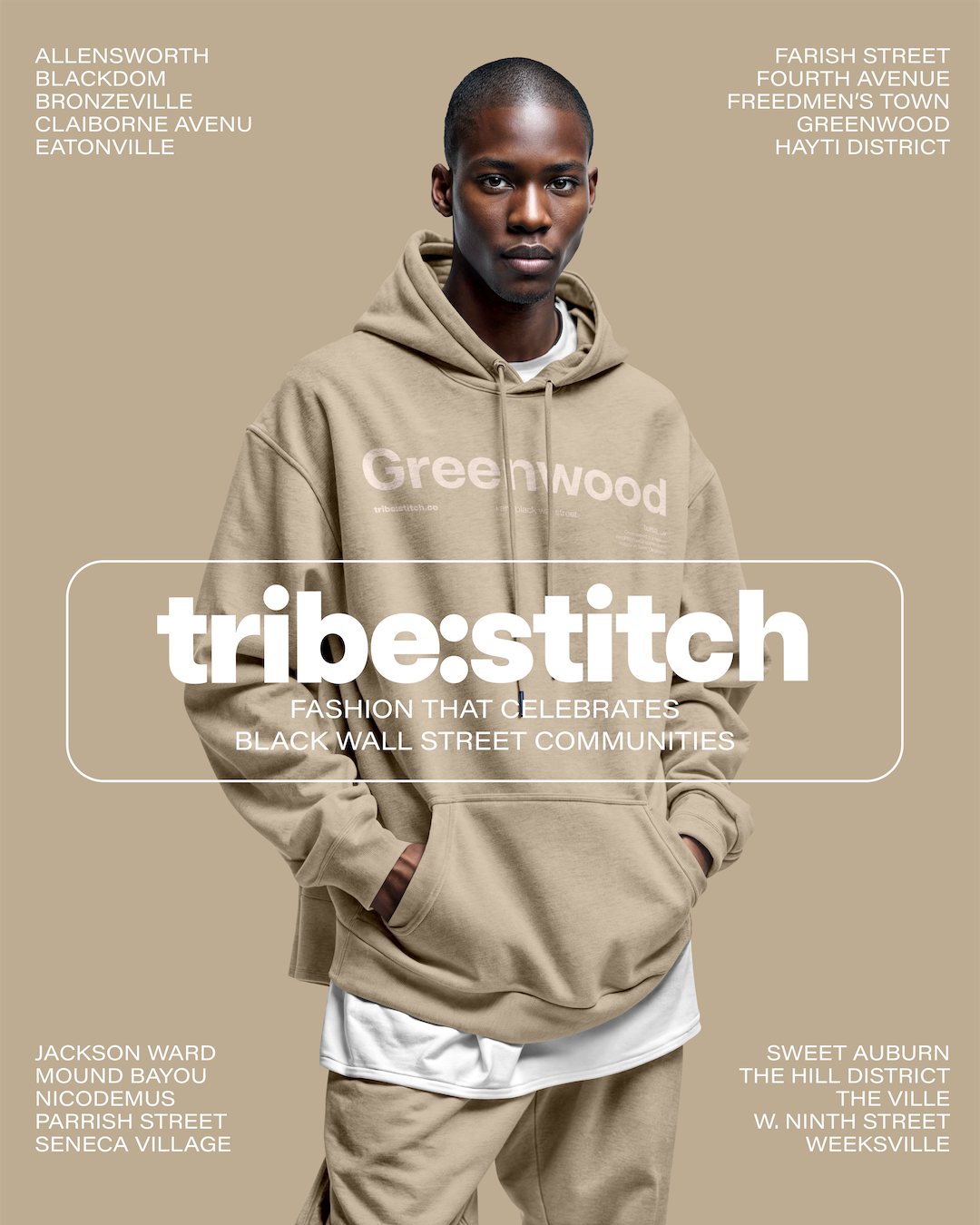

According to Allegory, the creative studio that helped develop it, BRANDED, BLACKNESS emerged as a direct response to this moment. In 2025, as big-box retailers began to retreat from DEI commitments, the platform’s founders approached Allegory with a straightforward ask: build a “visually rich and comprehensive guide” to Black-owned beauty and wellness brands that consumers could support directly, whether or not those brands remained on national shelves.

The result is not just another directory, but a curated guide. BRANDED, BLACKNESS focuses on “crown (hair), skincare, beauty and wellbeing” brands—categories where Black consumers have long complained of being underserved, even as they overindex on spending. Its messaging, refined through a customer-oriented branding process, centers two promises: that listed brands are Black-owned, and that they have demonstrated the ability to “well-serve their core market.”

On social media, the project describes itself as “your guide to Black-owned brands that offer products directly or through retailers,” often citing estimates that there are more than 3 million Black-owned businesses nationwide—a figure broadly consistent with Brookings’s count of 3.12 million Black-owned firms, including non-employer businesses.

In an era when trust is as valuable as aesthetics, that kind of curation is its own form of infrastructure.

What it feels like to shop with a guide

Buying from a Black-owned business is often described in abstract terms: an “investment in community,” a “recycling of the Black dollar,” a way to close the racial wealth gap. Those phrases are accurate. They are also somewhat bloodless.

On the level of everyday life, the choice often looks much more ordinary.

A bank customer logs into her account at a Black-owned bank—one she moved to during the 2016 Bank Black wave—after seeing social media campaigns laying out how deposits can translate into loans for Black homeowners and entrepreneurs. The interest rate on her checking account is not radically better than at the national chain she left. The mobile app is, if anything, clunkier. But each time she sees a news story about a loan program for local Black-owned restaurants or a partnership with a neighborhood nonprofit, she feels a small, concrete connection between her balance and someone else’s chance.

A few states away, a father trying to learn how to care for his daughter’s natural hair opens BRANDED, BLACKNESS on a Sunday afternoon. The guide sends him not just to products, but to brands whose marketing doesn’t treat his daughter’s coils as a “problem,” and whose social feeds offer tutorials created on hair that actually looks like hers.

For others, the transformation is psychological. In interviews and profiles of Black-owned bookstore and café customers during the 2020 surge in anti-racist reading, many described buying from Black businesses as a way to feel less alone: to walk into a space where the bookshelves or wine lists or beauty displays had been assembled with them in mind.

That feeling—of being seen not just as a consumer, but as a central, normative customer—is what many of these guides try to scale.

Beyond the moment: limits of a strategy

To say that buying Black can’t, on its own, undo centuries of racial capitalism is almost a cliché at this point. Critics have long warned that “conscious consumption” risks becoming a kind of pressure valve, inviting individuals to shop their way out of structural problems that require policy. Scholars have noted that campaigns to “buy Black” are often driven by noneconomic goals—racial pride, solidarity, the desire to build institutions that can’t be yanked away in the next election cycle.

Even some of the business owners most celebrated in #BuyBlack lists are clear about the limits. As one founder told a reporter during the 2020 surge, the spike in orders after her brand appeared in dozens of “Black-owned businesses to support” roundups was welcome—but without long-term investment, better access to capital, and changes in how large retailers allocate shelf space, none of it guaranteed survival.

The data backs them up. Black entrepreneurs start their businesses with about one-third of the startup capital that white entrepreneurs do and report higher levels of debt relative to revenue. Black-owned employer firms generate significantly more revenue and wealth for their owners than non-employer firms, but reaching that stage requires exactly the kinds of financing and contracts that have historically been hardest to secure.

Directories—even beautifully designed, highly curated ones like BRANDED, BLACKNESS—cannot fix those credit scores or rewrite procurement rules. What they can do is remove one layer of friction: the simple, frustrating difficulty of finding Black-owned options in the first place.

A parallel infrastructure

Taken together, the new generation of Black business guides looks less like a single movement and more like a loose, overlapping infrastructure.

There are hyperlocal directories, like Buy Black Baltimore 365, that grow out of Facebook groups and neighborhood word-of-mouth. There are national certification systems like ByBlack, meant as much for corporate procurement officers as for everyday shoppers. There are curated lists aimed at specific demographics—Black women-owned businesses, vegan soul food, Black winemakers—and there are marketplaces, from We Buy Black to Afrobiz World, that function like miniature Amazons built on the logic of racial solidarity.

BRANDED, BLACKNESS sits inside this ecosystem with a particular focus: creative Black beauty and fashion brands, and the consumers who want to support them without sacrificing aesthetics, quality, or convenience. Its brand architecture, developed with Allegory, leans into visual storytelling—luminous product photography, bold typography, social templates that look at home on Instagram grids already filled with editorial beauty shots.

The bet is simple: if you make the act of finding and shopping Black-owned feel less like homework and more like a natural extension of how people already discover and buy products online, more of those trillions in Black buying power will flow through Black-owned channels.

And not just in spikes—on paydays and holidays and anniversaries of uprisings—but on an ordinary Tuesday, when someone is out of conditioner.

What happens next

Whether that bet pays off will depend on factors far beyond any single guide’s control: interest rates, Supreme Court rulings, state-level crackdowns on DEI, and the willingness of Black consumers themselves to keep pushing against the gravitational pull of convenience.

If recent trends are any indication, though, the appetite for alignment is not going away. Surveys show that Black audiences are not only spending more time with digital media than the general population, but also more likely to be influenced by online recommendations and social buzz—exactly the channels where platforms like BRANDED, BLACKNESS operate.

At the same time, the rollback of corporate DEI has made clear that representation gained through fragile, executive-level promises can be just as quickly reversed.

That tension—between the fleeting access of a shelf tag and the slower work of building independent discovery tools—may define the next decade of Black economic organizing.

For now, though, in that fluorescent aisle, the choice feels both small and specific. A consumer scrolls through BRANDED, BLACKNESS, finds a Black-owned brand whose story resonates, whose product images look familiar in the best way, and reaches for the bottle.

It is only a purchase. It is also, quietly, a decision about whose future that money helps to build.