KOLUMN Magazine

The

Million

-Dollar Seniors

By KOLUMN Magazine

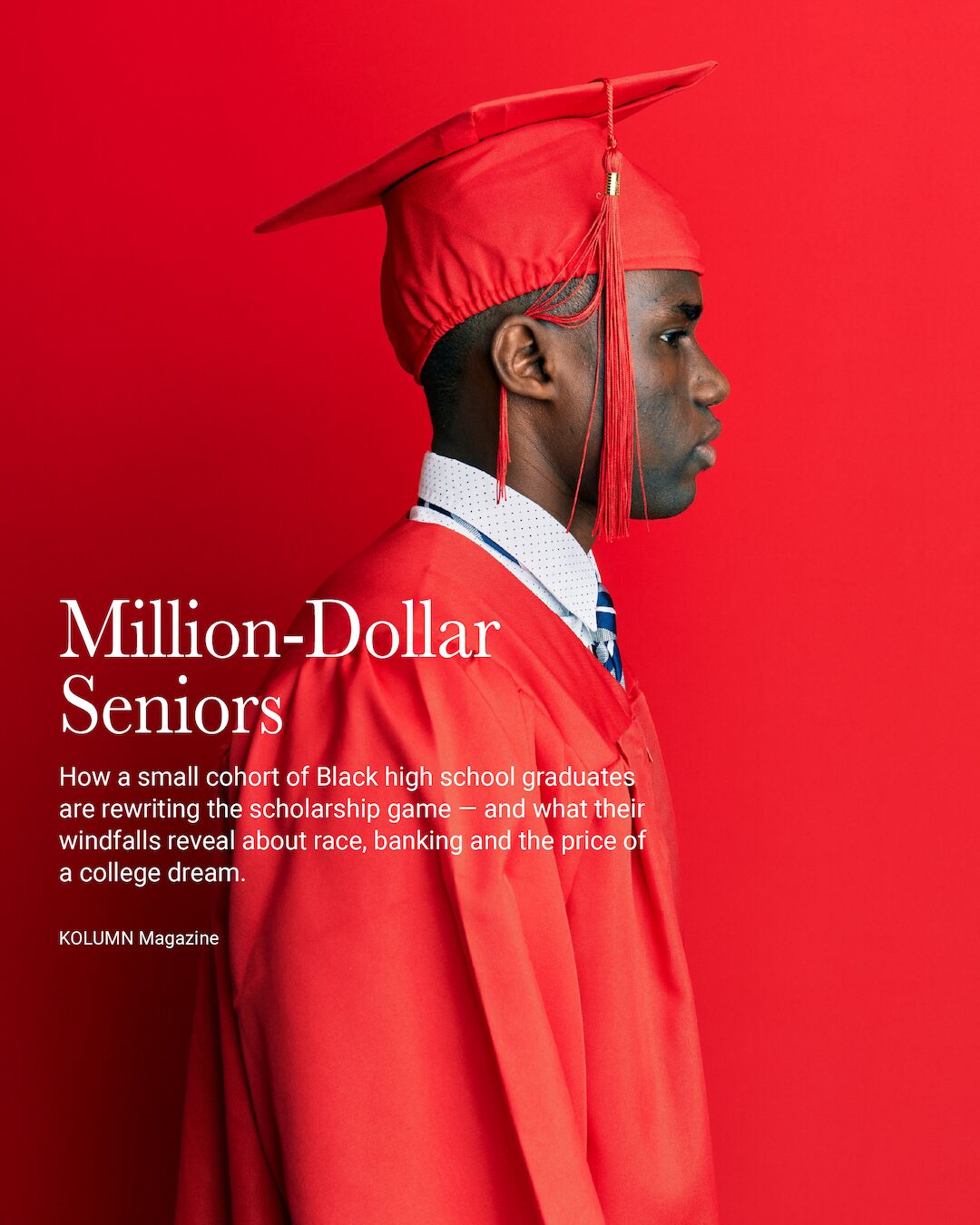

On a gray April afternoon in New Orleans, the spreadsheet on Dennis “Maliq” Barnes’s laptop started to look less like a list of possibilities and more like a ledger from another world.

Column A held the names of colleges — big public flagships, small religious schools in the Midwest, a smattering of Ivies. Column B tracked acceptances. Column C, the one that made his parents’ voices catch, tracked money.

Barnes, a wiry 16-year-old senior with a nearly perfect 4.98 GPA, had taken to updating the sheet the way some teenagers refresh TikTok: compulsively, almost nervously. By the time the last financial-aid letters rolled in, the number in the bottom-right cell — the sum of every institutional offer, merit award and “presidential scholarship” — had climbed past $10.1 million, a figure that set a national record for scholarship offers to a single student.

His counselor suggested they double-check the math.

His father suggested they double-check the bank.

“We had never seen numbers like that next to our name,” Barnes later told a local reporter. “First thing we did was sit down and talk about where that money actually goes — what’s real, what’s just a headline.”

On a coffee table not far from his laptop lay another stack of documents: pamphlets from local credit unions and national banks, brochures for “college checking” and “starter savings” accounts, and a print-out of an FDIC fact sheet his counselor had slid across the desk. It showed that even as the share of “unbanked” households in the U.S. has fallen to record lows, more than one in ten Black households still lack a basic checking or savings account — a rate roughly five times that of white households.

Barnes had broken into rare air — that tiny, news-making sliver of African American high school graduates who secure scholarship offers vastly above the national norms. But before a single tuition bill could be paid, he and his family had to navigate a different gatekeeper: the American banking and financial-aid system, with all its fine print, fees, and centuries-old racial gaps.

This is a story about that small cadre of Black high school seniors who manage, against the odds, to stack up life-changing scholarship awards. It is also a story about the financial plumbing that lies beneath their success — about who wins scholarships in the first place, who gets to safely bank them, and what happens as race-based aid comes under political attack.

The outliers

In the ecosystem of American financial aid, full-ride scholarships are vanishingly rare. One analysis estimates that just one-tenth of one percent of students ever see something close to a full ride. At the other end of the spectrum, roughly 97 percent of scholarship recipients receive less than $2,500.

Against that backdrop, students like Barnes read almost like urban legends.

In Chicago, 18-year-old Aaron Williams graduated as valedictorian of Bogan High School and walked across the stage knowing he’d been accepted into more than 80 colleges and offered over $8 million in scholarships. News clips describe the long arc that got him there: advanced classes, leadership roles, test prep wedged between shifts at a part-time job. When a local TV segment flashed his acceptance tally, the anchor’s voice jumped an octave.

In New Orleans — a city that has quietly become a kind of capital of scholarship super-achievers — another senior, Jada Jerrelle Brown, was accepted into 141 colleges and offered $5 million in scholarships, an amount that set a record in her year.

“I’m very happy, blessed, thankful,” Brown told a local station, admitting that being courted by more than a hundred institutions had felt “overwhelming” but also clarifying: proof that the late nights and weekends spent drafting essays — and combing through scholarship websites from a family computer — had not been in vain.

In each case, the headlines focused on the totals. Ten million. Eight million. Five million. The numbers had a kind of jackpot shimmer, easy to share on Facebook, easy to misinterpret. But talk to financial-aid experts and the picture comes into focus: these are not cash payouts; they are overlapping offers of tuition discounts, housing stipends and program-specific awards, many of which cannot be used simultaneously.

Still, for families like the Barneses, Williamses and Browns — often first-generation college-goers from neighborhoods where median household wealth trails the national average by hundreds of thousands of dollars — the sums represent something concrete: options. Where earlier generations of Black students often had to take the one school that made financial sense or pile on loans, these students can construct an actual choice.

The average scholarship — and the racial odds

It is tempting to treat these students as proof that the system works: Study hard, apply widely, write earnest essays about leadership and resilience, and the money will follow.

The aggregate data paint a more complicated picture.

Across the country, the average scholarship or grant aid available to an undergraduate student hovers around $7,000 to $10,000 a year, depending on how you count institutional discounts and federal aid. For many low-income families, that barely dents the cost of attendance at a four-year college, which the College Board estimates now averages well over $25,000 a year at public institutions and far more at private ones.

And even before the Supreme Court’s 2023 decision ending race-conscious admissions, Black students were less likely than white peers to win scholarships at all. Federal data and independent analyses show that white students have roughly a 14.2 percent chance of receiving a scholarship, compared with 11.2 percent for minority students overall. Among minorities, Black students’ odds — around 11.4 percent — are slightly higher than those of Hispanic and Asian students but still lag white peers, who capture a disproportionate share of private and institutional aid.

At the same time, Black undergraduates are more likely to rely on federal grants — such as Pell — and more likely to borrow. In one federal snapshot, nearly 88 percent of Black undergraduates received some kind of grant, compared with 74 percent of white students, yet 71 percent of Black students also took out loans, versus 56 percent of white students.

Layered on top of those disparities is what economists at the Federal Reserve and Brookings Institution describe as an “implicit subsidy” in financial aid: students from white families, even at similar income levels, tend to receive larger effective discounts in the form of grants and institutional aid than students from Black families. One working paper estimated that white students receive an implicit subsidy roughly $2,200 per year higher than Black students, contributing to as much as 10 to 15 percent of the gap in college completion and student-debt outcomes between the two groups.

In that landscape, the handful of Black students who blow past the average scholarship amount are not merely overachievers; they are statistical outliers bending a system that has historically tilted away from them.

How to build a million-dollar résumé

Spend time with counselors who specialize in helping Black students hunt for scholarships and a pattern emerges: the money rarely arrives all at once. It comes in $500 awards from local sororities, $1,000 checks from credit-union foundations, $10,000 pledges from national corporate partners, $40,000 from venerable programs like the Ron Brown Scholar Program, and — for a tiny few — full-cost packages from elite private colleges.

The Instagram feed of Capture Greatness, a Philadelphia-based scholarship coaching organization, is an almost dizzying scroll of Black teenagers grinning beside giant checks and acceptance letters. “$10 Million in Scholarships Secured,” one post announces, tallying the cumulative awards its students have brought in.

Behind every smiling post is a grind that starts years earlier:

Early financial literacy. In some school districts, banks and credit unions run youth savings or “Bank-At-School” programs, opening low-fee accounts for students and pairing them with basic budgeting lessons. An FDIC pilot found that when banks tied youth savings accounts to financial-education curricula, participation among low- and moderate-income students rose — and with it, familiarity with banking.

Scholarship culture. At places like International High School in New Orleans and Bogan High in Chicago, scholarship applications become almost a team sport. Counselors compile weekly lists; seniors swap essay drafts and recommendation tips. Barnes has credited his college counselor with pushing him to keep applying once he realized he might break the scholarship record.

Strategic college lists. Instead of chasing only name-brand schools, many high-achieving Black students target regional universities and HBCUs that are hungry for top talent and willing to pay for it. UNCF, the nation’s largest private provider of scholarships to Black students, distributes more than $60 million in awards annually to over 11,000 students and supports 37 historically Black colleges and universities.

Small dollars that matter. Research on “children’s savings accounts” — small-dollar accounts earmarked for education — suggests that even modest savings can have outsized effects. Black children who report at least $500 in school-designated savings are significantly more likely to enroll in and complete college than similar peers with no savings, independent of family income.

Put differently: by the time we see a headline about a teenager with eight-figure scholarship offers, we are looking at the tip of a long, mostly invisible process involving banks, counselors, parents, and a web of scholarship providers.

The bank in the background

If scholarships are the front door to college, bank accounts are often the back door — the place where refund checks land, where work-study earnings are deposited, where financial aid is quietly mismanaged or multiplied.

For Black families, that back door has long been harder to access.

According to the FDIC’s most recent survey of household banking, 11.3 percent of Black households were “unbanked” in 2021, meaning no one in the family had a checking or savings account at an insured bank or credit union. Among white households, the figure was just 2.1 percent.

Even when Black families do have accounts, they are more likely to be “underbanked” — using payday lenders or check-cashing services in addition to traditional banks — and to spend a higher share of their income on financial-services fees and interest.

That matters when a teenager suddenly becomes, on paper, a million-dollar scholarship recipient.

Counselors describe students arriving with institutional refund checks and no idea how to safely deposit them. Students whose parents are wary of banks sometimes turn to prepaid debit cards or cash, making it easier to lose track of spending and harder to build credit. Others open starter accounts at national banks or neighborhood credit unions, only to run afoul of overdraft fees that nibble away at work-study wages.

An emerging set of programs — from municipal “college savings” initiatives to fintech apps aimed at Black families — tries to bridge that gap. In St. Paul, Minnesota, for example, every newborn receives a college savings account held by a local bank, with the city and philanthropic partners seeding deposits; families can track and add to the savings via a mobile app. In other cities, children’s savings accounts are paired with mandatory financial-education classes, including field trips to banks where students make their first deposit as a class.

For students like Barnes and Williams, these relationships can be quietly transformative. The same banks that once redlined their grandparents’ neighborhoods now hold their tuition refunds and summer internship paychecks. Whether those accounts become engines for wealth-building or simply passthroughs for student-loan disbursements depends on a series of small decisions: automated savings transfers, credit-card offers accepted or declined, fees noticed or ignored.

Scholarships in a post-affirmative-action world

The stories of Barnes, Brown and Williams unfolded just as the rules of the scholarship game began to shift under their feet.

In 2023, the Supreme Court’s decision in Students for Fair Admissions v. Harvard curtailed race-conscious admissions. Soon after, conservative legal groups and policymakers turned their attention to scholarships, arguing that awards targeting “underrepresented” students violated civil-rights law.

Between March 2023 and June 2025, the share of scholarships in a major national database that explicitly used race, ethnicity or gender as eligibility criteria dropped by roughly 25 percent, according to reporting in the Wall Street Journal.

Some programs — including long-standing scholarships for Black medical students in Ohio and agriculture students at historically Black land-grant universities — were paused, rebranded or broadened to all races under pressure from state officials and legal threats. Others quietly stripped race from their eligibility language, swapping it for more litigation-proof proxies like income, geography or “commitment to diversity.”

Students interviewed by education reporters have described the effect of those changes as a narrowing of the path they are trying to walk. Race-based scholarships were never the majority of aid, but they were often the final bridge that turned an acceptance into an affordable option — especially for first-generation Black students whose families have little accumulated wealth to fall back on.

At the same time, philanthropic giving aimed at Black students, particularly those attending HBCUs, has spiked. UNCF, which has helped more than 500,000 students earn college degrees since its founding in 1944, reports that African American UNCF scholarship recipients graduate at a rate of roughly 70 percent, compared with about 40 percent for Black college students overall.

High-profile gifts from donors like MacKenzie Scott — who has given more than half a billion dollars to HBCUs and recently pledged $70 million to UNCF to strengthen endowments at 37 Black colleges — have allowed schools to expand their own scholarship offerings, reduce students’ reliance on loans and invest in support programs that help low-income and first-generation students stay enrolled.

But even these philanthropic surges are not a substitute for structural equity in federal and institutional aid. Economists estimate that the implicit subsidy skewing toward white students adds up to about $2.3 billion a year — roughly twice the annual budget of the federal work-study program. It is hard to imagine even the most generous donors closing that gap on their own.

After the cameras leave

Months after his scholarship tally went viral, Barnes made a choice that in some ways shrank all those zeroes back down to a human scale. He pulled on a red and white sweatshirt, stood at a podium at his high school, and told reporters he had chosen Cornell University’s College of Engineering. The decision, he said, came down to program quality, financial fit and “where I can see myself thriving.”

The announcement did not change the structural forces that had shaped his journey: the underfunded New Orleans schools he attended as a child, the racial wealth gap that meant his family could not simply write a check, the bank-access disparities that make even a basic checking account a hurdle for many Black households.

But it did mean that, for one Black teenager, those forces had been held at bay long enough for something else to happen. A child of a city where college once seemed, at best, an expensive gamble, became a young man comparing interest rates on student bank accounts and planning an engineering degree in the Ivy League.

The same spring, in Chicago, Williams narrowed his 80-plus offers down to a handful, weighing not just the size of each scholarship but the strings attached: GPA requirements to keep aid, campus jobs baked into packages, loan components masquerading as “awards.” In New Orleans, Brown sat at her own kitchen table running the math on room-and-board costs and travel home, trying to make sure the school she chose would still feel possible once the first-year dust settled.

Their stories are extraordinary. They are also reminders that extraordinary effort is often required of young Black Americans just to reach the starting line on roughly equal financial footing.

Scholarships — and the bank accounts that hold them — are tools. They can narrow the racial wealth gap or reproduce it, depending on who gets access, on what terms, and for how long.

For now, as one school year turns into another, seniors in gyms and auditoriums across the country will step up to podiums and announce their own numbers: $50,000 from the local credit union foundation. A full-ride from a state flagship. $5,000 from a small Black-led nonprofit down the street.

Somewhere, a counselor will hand them not just a scholarship certificate, but a brochure for a starter checking account. Somewhere else, a parent will sit at a kitchen table, read through the terms of a college savings app, and decide whether this bank — this system — can be trusted with their child’s future.

And somewhere, in a living room in a neighborhood that bank branches once bypassed, a teenager will open an email, add another row to the spreadsheet, and watch as the number in the bottom-right cell creeps closer to a life they’d once only seen on television.